Evaluating hydrogen investments adds value to clients

Jussi-Pekka Kuivala, the director of energy consulting at Fimpec, works at the forefront of clean energy solutions. He sees the hydrogen industry as having the potential to grow into one of Finland’s most significant industrial sectors, transitioning from a fossil-based economy to a more sustainable future. In his article, he emphasizes the importance of the hydrogen value chain and the correct selection of hydrogen derivatives for Finland.

Hydrogen and its derivatives have long been a hot topic in the clean transition. Solutions are being sought from hydrogen and its derivatives to detach from fossil fuels, thereby reducing climate emissions, minimizing energy dependence outside the EU, and generally serving as an engine for the economy.

In 2023, the Finnish government set a goal for Finland to achieve a leading position in the hydrogen economy in Europe. The hydrogen strategy noted that Finland has the potential to produce at least ten percent of the EU’s emission-free hydrogen by 2030. This provides good prospects for companies to invest in new innovations and make investments, as a clean transition is inevitably coming.

Finland should aim at the top of the hydrogen value chain by attracting industries that use hydrogen to manufacture derivatives. For a hydrogen economy to emerge, costs need to drop, regulatory requirements need to be specified, and the functionality of the value chain and its role in bearing costs need to be examined.

For derivatives to be utilized, a lot of raw materials needs to be produced. Finland has excellent opportunities to fully launch the hydrogen economy and implement new investments, thanks to our geographical location, societal stability, high level of education, and our ability to produce raw materials needed in the power-to-X process.

We have space to build cost-effective green electricity production, such as wind and solar power, and our forest industry’s biogenic carbon dioxide is waiting to be harnessed for large-scale production of electric hydrocarbons. In electrolysis, the water used as raw material must be particularly clean, giving Finland a definite competitive advantage over many other countries. In Finland, water is already fairly clean and abundant.

The value chain will not be hindered by hydrogen infrastructure either, as Gasgrid, owned by the Finnish state, plans and develops a national hydrogen network that would connect both hydrogen producers and consumers and link Finland to the hydrogen economy market in Europe.

Hydrogen derivatives shape the future

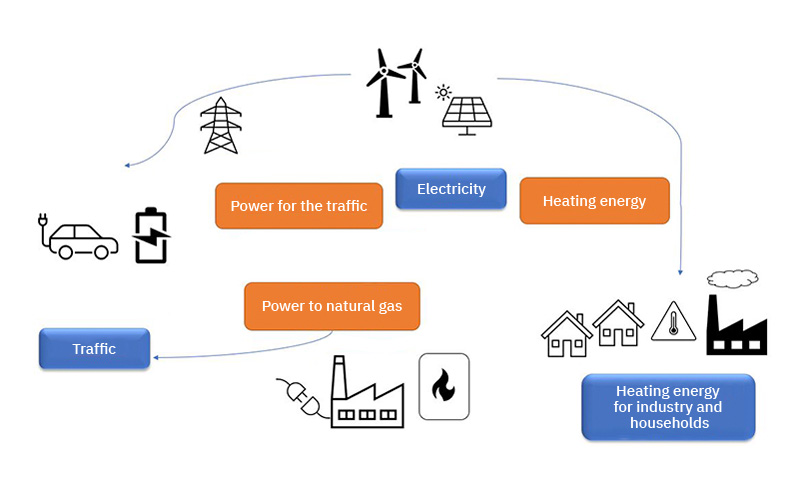

It is important for businesses to identify where in the hydrogen value chain it is advantageous to position themselves. Project developers and energy companies can invest in hydrogen production facilities where green hydrogen is produced through electrolysis using renewable electricity. The produced hydrogen can be further processed or companies can aim for a broader position in the value chain and manufacture the derivative themselves.

Existing applications and markets for derivatives can be found, for example, in transportation and the chemical industry. Hydrogen can be processed into e-methane, which can be sold in the existing natural gas market in Finland and the Baltics through bilateral agreements.

The distribution obligation enables another existing market for e-methane. The EU increasingly requires emissions-free transportation, and the distribution obligation has been set so that a certain percentage of distributed transportation fuel must come from renewable sources. In 2024, the distribution obligation is 13.5% and will gradually rise to 22.5% by 2027. The distribution obligation also includes an additional obligation for so-called advanced fractions, such as e-methane, which is two percentage points of the total distribution obligation this year. This specific additional obligation opens up the market for hydrogen-derived products.

As maritime transport fully joins the EU’s current emissions trading system by 2026 and the Fuel EU Maritime regulation comes into effect, the pressure to adopt alternative and emission-free fuels increases. Ammonia and methanol are predicted to be the new fuels that could replace diesel in ships, and major shipping companies have already placed orders for ships that use these hydrogen value chain-related fuels. Demand is thus expected also in maritime transport.

In the value chain, we cannot rely solely on fuels. Ammonia is a significant raw material in fertilizers, thus touching the food industry. Methanol is a significant raw material in the chemical industry and also opens up the possibility of manufacturing plastics from fully renewable raw materials.

Steel can also be produced using hydrogen, which enables fossil-free steel production. The automotive industry has already shown interest in fossil-free steel as enlightened consumers and companies increasingly demand more environmentally friendly vehicles. The share of renewably produced steel in the total cost of car production is still moderate but accelerates investments in green steel production.

Race toward a leading position in the hydrogen economy

Competition for industrial investments related to the hydrogen value chain will be fierce globally, but also within the EU. In this race, it is possible for us to secure the future well-being. In recent years, EU countries, primarily industrial giants like Germany and France, have supported green transition projects with billions of euros.

Finland may not win this support race, although the government in the April framework session decided to target a tax credit for large and especially green transition projects. A tax credit could be granted for 20% of the total investment amount of the project, but no more than 150 million euros per individual project.

The permitting process is also becoming clearer and faster with the new so-called clean transition placement permit, as municipalities can, if they wish, combine zoning and permitting phases. The state does what it can to facilitate investment decisions and smooth the process, but ultimately Finland must compete with its advantages, such as our ability to produce significantly cheaper renewable electricity, our forest industry’s biogenic carbon dioxide emissions, and clean water.

We hold the winning cards that enable various hydrogen value chains. With these, we can secure our place as a leading hydrogen economy and achieve economic well-being for the entire society.

Fimpec as a partner in hydrogen and power-to-X projects

We at Fimpec have been at the forefront of developing the hydrogen economy since 2014 and have acted as a partner in green hydrogen and Power-to-X pioneer projects, including those of P2X Solutions and Nordic Ren-Gas Oy.

Our strength lies in recognizing market potential, evaluating investment profitability, and advancing projects. The biggest question for customers right now is cost: how to reduce the production cost of hydrogen and who to sell the clean hydrogen to?

Our management consultants support our clients in project evaluations, help identify off-takers for hydrogen and its derivatives, produce market and techno-economic feasibility studies, and outline the big picture of positioning in the hydrogen value chain.

Want to know more? Contact:

Panu Rahikka

Managing Director,

Fimpec Consulting Oy

CONSULTING SERVICES

+358 44 090 4266